24 May 2022

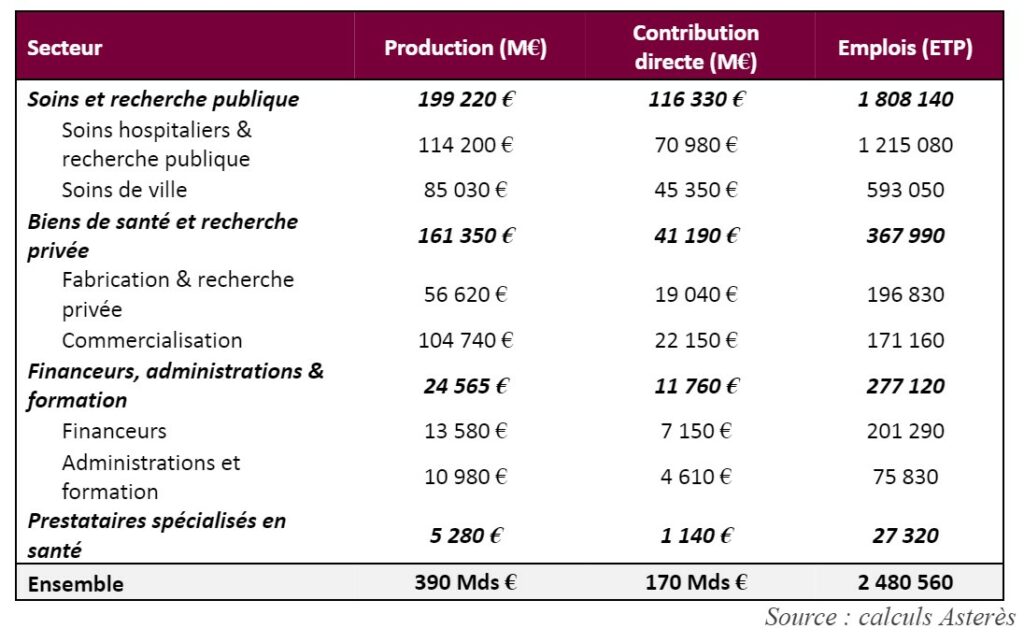

In France in 2019, the last full year before the health crisis, care actors accounted for 7% of GDP and 9% of jobs, i.e. €170bn in net contribution, €390bn in output and 2.5 million full-time equivalent jobs.

Care is therefore the 3rd largest sector (as defined by the French Nomenclature of Activity at level A21) in terms of net contribution, output and jobs, behind manufacturing and trade. The care sector is defined here as all actors specialising in human health and includes, for example, non-regulated professions (such as psychotherapists or osteopaths), the funders of the health system (Social Security and complementary organisations), the administrations (ARS and the Ministry of Health) and companies specialising in health services. The study excludes animal health and actors who act indirectly on health (such as food or sport). Finally, the evaluation of the socio-economic weight of care does not take into account the spillover effects on the rest of the economy but only the value that is lodged directly with the care actors.

Care can be divided into four main sectors: care, drugs and medical devices, financiers, administrations and training organisations and finally specialised health providers.

Care and related public research have the highest net contribution, the highest output and employ the highest number of care workers. This sector is made up of hospital care, hospital and public research and community care. Public research is treated here jointly with public hospital care because of their proximity, particularly within establishments such as the Institut Pasteur or the Institut Curie. This sector is very labour-intensive and has a high level of intermediate consumption expenditure (hotel costs, equipment and consumables in particular). The sector employs 1.8 million people (FTEs) and generates an annual net contribution of €116 billion, i.e. more than the construction sector, for €199 billion of production. France’s good position in certain clinical trials (such as CAR-T) and the worldwide reputation of several research centres or hospitals (Inserm, Institut Gustave Roussy) ensures a connection between academic advances and care. Private companies, accompanied and financed in particular by public structures, stimulate organisational innovation (cooperation and delegation of tasks between carers) and technological innovation (tele-expertise, digital monitoring).

The manufacture and marketing of medicines and medical devices (MDs) and associated private research is the second largest care sector in terms of net contribution and output, but employs relatively few people. This sector, which brings together manufacturers and traders, is highly productive. As the R&D carried out by pharmaceutical laboratories and medical device producers is intrinsically linked to their production activities, Asterès has chosen to present them together. With a net contribution of €41 billion, i.e. as much as the real estate sector, €161 billion in production and 368,000 employees (FTEs), drugs and medical devices constitute the second concentric circle of care: the players are not in contact with patients but provide the equipment essential for care. These players invent, develop, produce and then distribute the innovations that are revolutionising care (via cell and gene therapies, immunotherapy, remote monitoring or surgical robots, for example).

Those involved in financing, regulating the supply of health care and health training constitute the third employer sector. With 277,120 jobs (FTEs), a net contribution of €12 billion, i.e. approximately that of the entire arts, entertainment and recreation sector, and €25 billion in production, this sector plays a key role in the proper functioning of the care system, but has a lower economic strength than the first two. The French model of health financing, with a mixed reimbursement of social security and complementary health insurance organisations, ensures a particularly low out-of-pocket expense for patients and relatively wide access to therapeutic innovation. Public actors play a central role in creating an environment favourable to the deployment of innovation via HAS assessments, price setting, financing of care and staff training.

Specialised health care providers have a modest net contribution, output and employment in relation to the care sector as a whole.The sector covers all the companies that provide services specifically for the health sector and has a net contribution of €1 billion, a production of €5 billion, i.e. more than the entire activity of the extractive industries in France, and employs 27,320 people. The major players in tech considerably optimise the market and the time of the players, specialised investment funds (Mérieux Equity Partners, Sofinnova, etc.) and incubators (Agoranov, Parisanté Campus, TechCare, etc.) enable the growth of promising projects, while a number of players offer specific services (consultancies specialising in health, innovative clothing, prevention tools). The abundance of private initiatives stimulates the health system from all sides and supports the traditional players.

Figure 1: Output, net contribution and full-time equivalent jobs of total care, 2019

Partager l'article

Study Reading time : 30min An economic study carried […]

Étude Reading time : 30min Care in France contributes […]

Executive summary Reading time: 2min Care: a major contribution […]